On 22 September, market research firm IDC released its report on China’s wearable shipment market in the second quarter.

Overall shipments were 28.57 million units, down 23.3% year-on-year. This follows a 7.5% year-on-year decline in the first quarter, and is another downward trend.

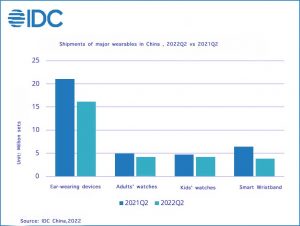

In terms of category breakdown, 16.18 million units of ear wear devices were shipped, down 23.2% year-on-year.

Of these, true wireless Bluetooth headphones, which play a major role, shipped 12.73 million units, down 22.1% year-on-year. The segment, which has been stimulated by updates to active noise cancellation features and falling prices, showed a distinct lack of drive, with most of the top brands seeing a decline in sales.

Under the declining trend, some local brands and white labels continued to update and improve, still evolving towards intelligence.

Shipments of wristband devices were 8.46 million units, down 12.3% year-on-year.

Of these, 4.23 million adult watches were shipped, down 14.5% year-on-year. Shipments of children’s watches were 4.24 million units, down 10% year-on-year.

Although the mid-year 618 event and some manufacturers’ new product launches had a stimulating effect on sales, the overall market environment and product feature iterations weakened the stimulus to purchase demand.

In addition, sales of bracelets declined most significantly this quarter, with shipments of only 3.83 million units, down 40.2% year-on-year.

As bracelets evolve more and more in the direction of large screens and watches, the category is gradually showing its weakness in the competition with smart watches.

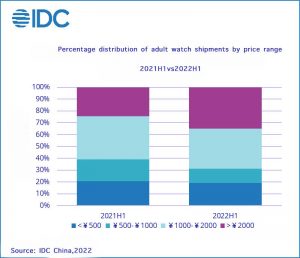

At the same time, IDC also gave data on the growth trend of smartwatch sales in different price brackets in the first half of 2021 and 2022, with watches in the price brackets of RMB 0~500, RMB 500~1000 and RMB 1000~2000 all declining to a greater or lesser extent, while only watches in the price bracket of RMB 2000 and above showed growth in shipments, with a figure of 29% year-on-year growth.

According to IDC, manufacturers will gradually focus on the high-end market in terms of product placement as they place more emphasis on revenue and profits than on shipment size during the market downturn.

On the consumer side, the overall willingness of high-income groups to spend was less impacted by the challenging economic environment.

In particular, the willingness and ability to consume smartwatches, which are relatively weak in terms of immediate demand, remains stable, and they are even more actively involved in daily exercise in order to improve their lifestyles in the direction of health, thus stimulating more consumer demand.

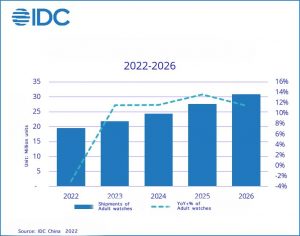

Based on the performance of annual watch shipments in the first half of this year, the current economic environment and other factors, IDC forecasts that adult watch shipments in China will decline by 3% in 2022, while the sales scale will be able to reach a growth rate of 8%.