According to IDC’s latest global wearable device market report for the fourth quarter of 2021 and the full year of 2021 released last week (March 21), we have a review of the market performance of the past year.

Because IDC has a very broad definition of wearable devices, it includes not only smart watches (adult watches, children’s watches), smart bracelets, and earphones and other audible devices, but also smart rings and smart glasses in the early stage of market development.

The report shows that global wearable device shipments reached a new high in the fourth quarter of 2021, reaching 171 million units, a year-on-year increase of 10.8%. Shipments for the full year were 533.6 million units, a year-on-year increase of 20.0%.

For the growth in shipments, IDC attributed it to the continued growth in demand for health and fitness tracking devices and hearables. Among them, the growth rate of hearable devices was significant, with shipments increasing by 9.6% year-on-year in the fourth quarter, accounting for almost 2/3 of the overall shipments of wearable products.

Smartwatches continued to increase their cannibalization of the wristband market, while segments such as smart glasses, smart rings, and smart shoes achieved 94.1% growth in the fourth quarter, mainly driven by the familiar Oura rings and Facebook’s partnership with Ray-Ban. Smart glasses and other manufacturers contributed.

This article interprets two IDC reports, analyzes the market performance of the global TOP 5 players, the performance of the Chinese market, especially the headset market, and forecasts the development trend of wearable devices in 2022.

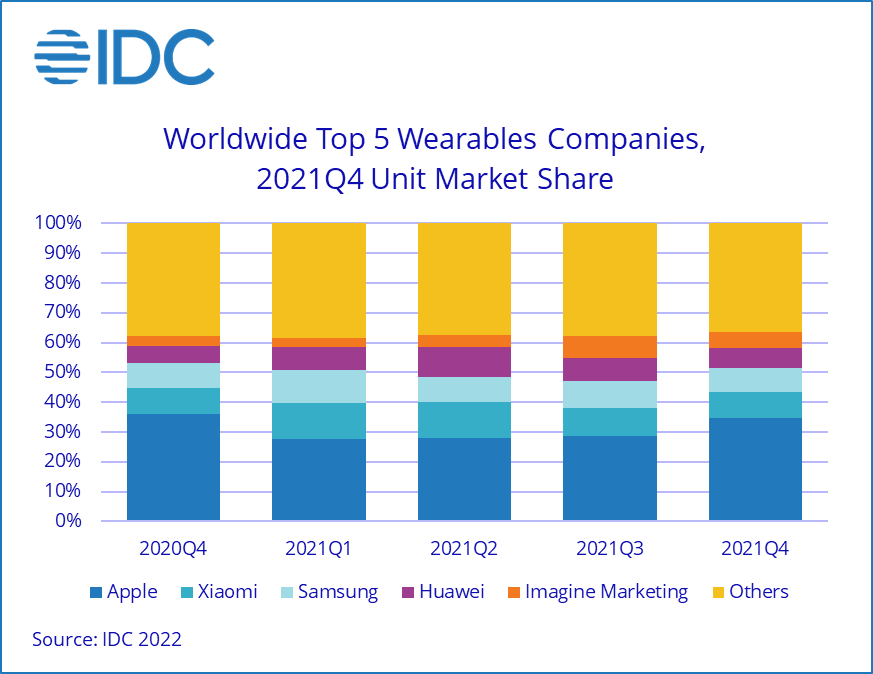

Apple had a stable performance in the wearable market last year, with quarterly shipments of 59 million units, a year-on-year increase of 7.3%. Annual shipments were 161.8 million units, a year-on-year increase of 6.8%. In the fourth quarter, global shipments accounted for 34.9%, and annual global shipments accounted for 30.3%, and its dominance remained strong.

In September and October last year, Apple held two consecutive conferences, successively launched the large-screen Apple Watch S7 and the cost-effective AirPods 3, and the Beats Fit Pro, which was designed with a unique design, was also launched in the same quarter, which jointly promoted Apple’s shipments in the fourth quarter. volume growth.

Xiaomi’s fourth quarter and full-year shipments ranked second, with shipments of 14.6 million units and 54.4 million units, up 7.9% quarter-on-quarter and 7.1% year-on-year.

As previously reported by Counterpoint, Xiaomi had a strong first half of 2021 with its Mi Watch Lite, while also releasing a new watch, the Redmi Watch 2 series, in the fourth quarter. In terms of headphones, Xiaomi is committed to “high-end”. In June, it released the first high-end Flipbuds Pro. The new Xiaomi Logo, a new design, the first Qualcomm QCC5151 main control chip, an external ADI noise reduction chip, and the headset tuning settings are also It can be said that it is completely new from appearance to kernel, from hardware to software.

Then, at the new product launch in September, another “high-end work”, the Xiaomi True Wireless Noise Cancelling Headphone 3 Pro, was launched, with the first LDAC 4.0, equipped with core functions such as spatial audio and dual transparency mode.

It is worth noting that in December, Xiaomi also released the lower-priced Xiaomi True Wireless Noise Cancelling Headphones 3, which achieved both “high-end” and “high-yield” at the rhythm of one headset every three months.

The third-ranked Samsung’s fourth-quarter shipment growth rate tended to slow down, reaching 13.6 million units, an increase of 3.8% year-on-year, and its full-year shipments reached 48.1 million units, a year-on-year increase of 20.1%.

As we all know, thanks to the launch of two models of the Galaxy Watch4 series, Samsung began to explode in the third quarter, with a month-on-month growth of more than 200%, which directly drove the rapid growth of shipments throughout the year. However, in the past fourth quarter, it can be seen that its growth rate has slowed down significantly. If you want to continue to maintain rapid growth, you need to come up with more competitive products. Recently, it has been reported that Samsung’s next-generation flagship watch, the Galaxy Watch, will be equipped with a temperature measurement function, and the battery life of the watch will be further improved.

Huawei’s shipments grew strongly in the fourth quarter, with 11.5 million units shipped, a year-on-year increase of 35.6%. The annual shipment was 42.7 million units, a year-on-year increase of 25.6%. Huawei’s release of the Watch GT3 in the fourth quarter and the Watch Fit Mini in the European market helped its shipments more than double quarter-on-quarter despite ongoing sanctions from the U.S. government.

In addition, Huawei also released a new true wireless Bluetooth headset FreeBuds Lipstick “lipstick headset” to the world, with high-resolution, high-value “lipstick” appearance, semi-in-ear noise reduction, AI adaptive audio technology, to create Huawei’s annual The most fashionable technology items.

The fifth place is Indian company Imagine Marketing, which shipped 9.2 million units in the fourth quarter and 26.8 million units annually, with a quarterly and year-on-year growth of 69.6% and 163.4%. Due to the rapid growth of wearable devices in India, its well-known brand BoAt has grown rapidly in the mid-to-low-end market.